Photo Radar Systems

The term “photo radar” is frequently only half right. Yes, the system always snaps a photo of a vehicle it considers to be speeding, but it doesn’t always measure that speed with radar.

Back in the eighties when it began appearing in a few U.S. municipalities, “photo radar” was the name applied to a mobile system using European equipment such as the Swiss-made Multanova 6F, which were packaged in vans. The enforcer drives to a location, at which point he makes a quick set-up that includes positioning a radar gun on a tripod along the road and aiming his cameras. The radar beam, almost always a continuous wave (CW) Ka band, is angled across the road, thereby weakening the signal available to approaching radar detectors. After an hour or two in one location, these photo-radar units usually move on to a new ambush.

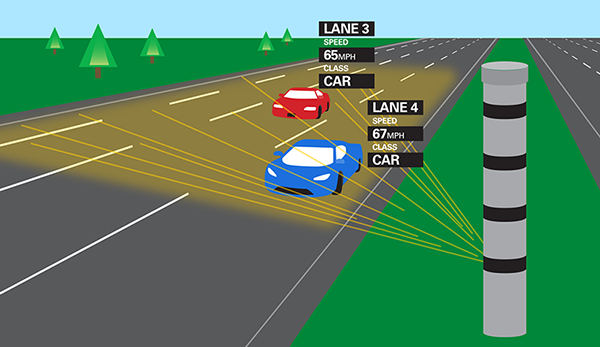

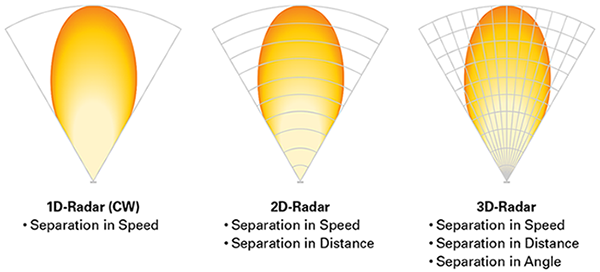

In the late 2000s, a new generation of photo radar systems started operating in the U.S. that are based on modulated K band radar. The 2D radar modulation technique used by these systems allowed objects to be separated by speed and distance, which permitted multi-lane speed enforcement. Around 2013, photo radar systems started using 3D radar modulation technique—referred to as “tracking radar.” 3D tracking radar is able to separate objects by speed, distance, and angle thus making it ideal for both speed and red-light enforcement. Modern systems use 3DHD or 4D radar modulation technique, which uses high-speed modulation for better object differentiation and resolution. Modulated K band photo radar can be either fixed or mobile, and its usually rear facing—it’s designed to record violations when moving away from the camera.

V1 warning on this threat: See V1Gen2 Photo Radar page for cameras supported.

Camera enforcement of traffic speed doesn’t always use radar. There are three other types you should know about:

1. Photo Laser. Light Detection and Ranging (LiDAR) and Light-Emitting Diode Detection and Ranging (LEDDAR) based speed camera systems work in much the same way as radar but, they use light energy (Laser or LED) instead of radio waves. These systems transmit laser or LED light pulses and measure the time difference between the emitted pulse and the return echo. This round-trip time of flight measurement between the camera and an object is used to calculate the distance to and speed of an object. For multi-lane enforcement, systems such as the Vitronic Poliscan scan horizontally (Scanning LiDAR) by using a rotating mirror to reflect the laser beam at several positions. Laser based photo enforcement systems can be fixed, mobile, or handheld (DragonCam). These laser systems will present a challenge to the idea of early warning from a laser detector, but they certainly will not be immune to detection.

V1 warning on this threat: Maybe, depends upon the situation.

2. Photo Enforcement using In-ground loop detector. Many of the red-light cameras installed in the 1990s and 2000s use wires buried in the pavement to sense when cars enter the intersection. With a software change, many of these systems were updated to do a time-distance calculation between the buried sensors, thereby indicating vehicle speed. If a violation is detected, the cameras already in place for red-light monitoring will picture the accused speeder. And the ticket will be issued by the same system in place for red-light violations. Adding this speed-on-green feature brings automated speed enforcement on the cheap.

Early in 2006, camera enforcement began along the 101 freeway in Scottsdale, AZ, with three cameras monitoring each direction over a 7.8-mile stretch. This is the first photo-speed enforcement on a U.S. freeway. These cameras are triggered by piezo loops buried in the pavement, a separate loop for each of three lanes. This allows the system to know which vehicle to accuse. Photos are taken by two cameras mounted on posts along the right side of the road, one shooting a front view to capture the driver’s face, the other aimed at the rear license plate.

Although most of these loop detector based systems have been replaced by the latest technology, a few still remain in operation in some municipalities.

V1 warning on this threat: None; it’s neither radar nor laser.

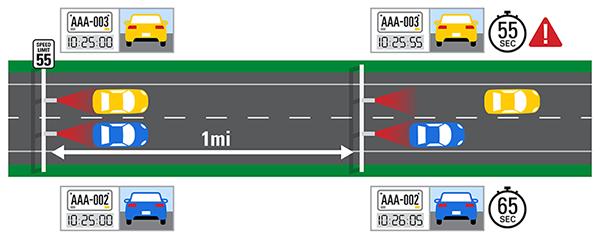

3. Point-to-point average speed systems. These systems are intended for limited-access highways where they would measure time intervals for each vehicle between points several miles apart or even farther. Imagine an automated VASCAR on a giant scale. Such a system would have beginning and end points, each consisting of an overhead structure with vehicle-recognition sensors (Automated License Plate Recognition) covering each lane. One sensor array records each vehicle entering the monitored stretch, another watches the exit. If a vehicle traverses the distance faster than allowed, its picture is taken by cameras along the road.

No systems of this sort are operating in the U.S.

V1 warning on this threat: None; this is a vehicle-recognition system not capable of measuring instantaneous speeds.

V1 warning on this threat: None; this is a vehicle-recognition system not capable of measuring instantaneous speeds.

With speed cameras generating millions of dollars in revenue for various cities, automated speed enforcement is sure to grow. Cities have found the promise of revenues to be irresistible.